are funeral expenses tax deductible in australia

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. They are never deductible if they are paid by an individual taxpayer.

Taxpack 2011 Supplement Australian Taxation Office

It is legal to deduct from the gross estate funeral expenses administration fees and any debts incurred by the estates administration Code Sec.

. If the estate provides the cost of burial or funeral expenses you may be able to deduct themAn estate executor or someone else who would like to minimize estate estate income when it comes to the estate settlement. Whats more this may not apply to your specific situation. A typical funeral will have these costs.

A familys funerals can be deducted from their taxes for funeral costs like urn preparation coffin preparation funeral esce casket hearse limousines and floral costs. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. There is no inheritance or estate tax.

Expenses relating to earning income that is not assessable such as money you earn from a hobby. As well as transporting the body for the funeral transporting the ket the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying. Funeral costs you pay for in advance normally dont count in your assets test for payments from us.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. In theory this means every cent you spend in your role as executor must be reimbursed to you out of estate monies these can include. In most cases funeral insurance premiums are not tax deductible.

If you itemize you will not be allowed to take the standard. There are some exceptions. There are a few exceptions though including final medical expenses and costs incurred by the decedents estate.

As executor of the estate you will be entitled to be reimbursed on all reasonable expenses you pay on behalf of the estate. This includes the cost of the funeral service burial plot and headstone. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return.

You cannot deduct funeral expenses for federal income tax purposes either as a family member or as a company though they may be deductible if your estate has filed. You can also deduct funeral and burial expenses from your taxable income. Certain funeral expenses can be deducted such as cemetery costs urn and urn attendant costs hearses limousines and flower delivery costs.

There are some expenses that are not deductible such as. Qualified medical expenses include. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

This means that you cannot deduct the cost of a funeral from your individual tax returns. Are Funeral Costs Tax Deductible In Australia. But theres generally no tax on the benefits that you or your beneficiaries will receive.

As well as claims against the estates certain taxes and certain debts incurred since July 1 2005. In other words funeral expenses are tax deductible if they are covered by an estate. Work out if there is tax on money or assets you inherited or are presently entitled to.

The Australian Tax Office has recently confirmed that small businesses would be able to deduct ping-pong tables if used in the business but a whole range of employee entertainment expenses are. The GST component of a purchase if you can claim. Services Australia acknowledges the Traditional Custodians of the lands we live on.

If the expense you are claiming is for both work and private purposes you can only claim the work portion of the cost. To be able to claim work related deductions you must meet the following criteria. Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible.

Taxpayers carrying on a business incurring deductible business expenditure. What you cant claim. To claim medical expenses on your tax return you must itemize your tax return.

Permits for example for a burial at sea or private land burial or. An itemized funeral expense list will allow you to deduct money spent on funeral expenses such as embalming cremation casket storage hearses limousines and florals. Many estates do not actually use this deduction since most estates are less than the amount that is taxable.

When someone dies the person dealing with the deceased estate will have tax and super issues to manage. When submitting a tax return you are entitled to claim deductions for expenses incurred while working - known as work related deductions. 22 Dec 2021 QC 23846.

If you are a beneficiary of a deceased estate. Rules for Claiming Funeral Expense Tax Deductions. Funerals can cost from 4000 for a basic cremation to around 15000 for a more elaborate burial.

Funeral expenses are not tax deductible because they are not qualified medical expenses. Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate. Deducting funeral expenses as part of an estate.

Deductible medical expenses may include but are not limited to the following. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

Private or domestic expenses such as childcare fees or clothes for your family. This guide will explain when funeral expenses are tax-deductible which ones qualify and how to claim. However its always possible that tax laws may change in future.

In short these expenses are not eligible to be claimed on a 1040 tax form. 27 May 2021 QC 64888. What Funeral Expenses Are Tax Deductible.

We pay our respects to all Elders past and present of all. Essential taxi fares phone call charges the Courts filing fee. Taxpayers other than individuals small business entities and entities that would be small business entities if the aggregated turnover threshold was 50 million incurring deductible non-business expenditure.

Select your payment or service to find out how this impacts you.

Are Estate Planning Fees Tax Deductible In Australia Ictsd Org

Managing The Tax Affairs Of Someone Who Has Died Ato Fact Sheet

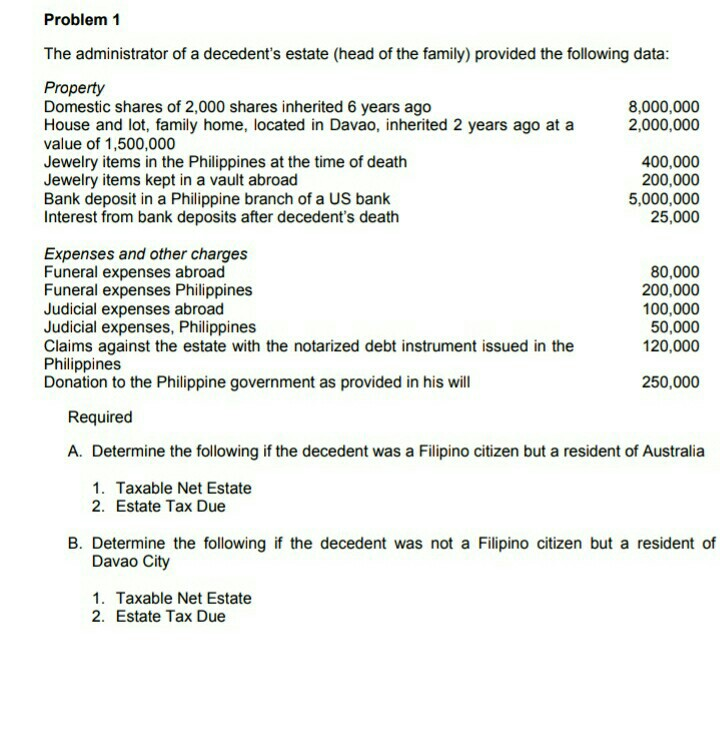

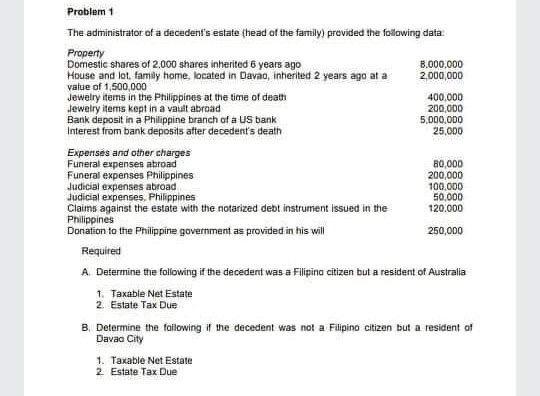

Solved Problem 1 The Administrator Of A Decedent S Estate Chegg Com

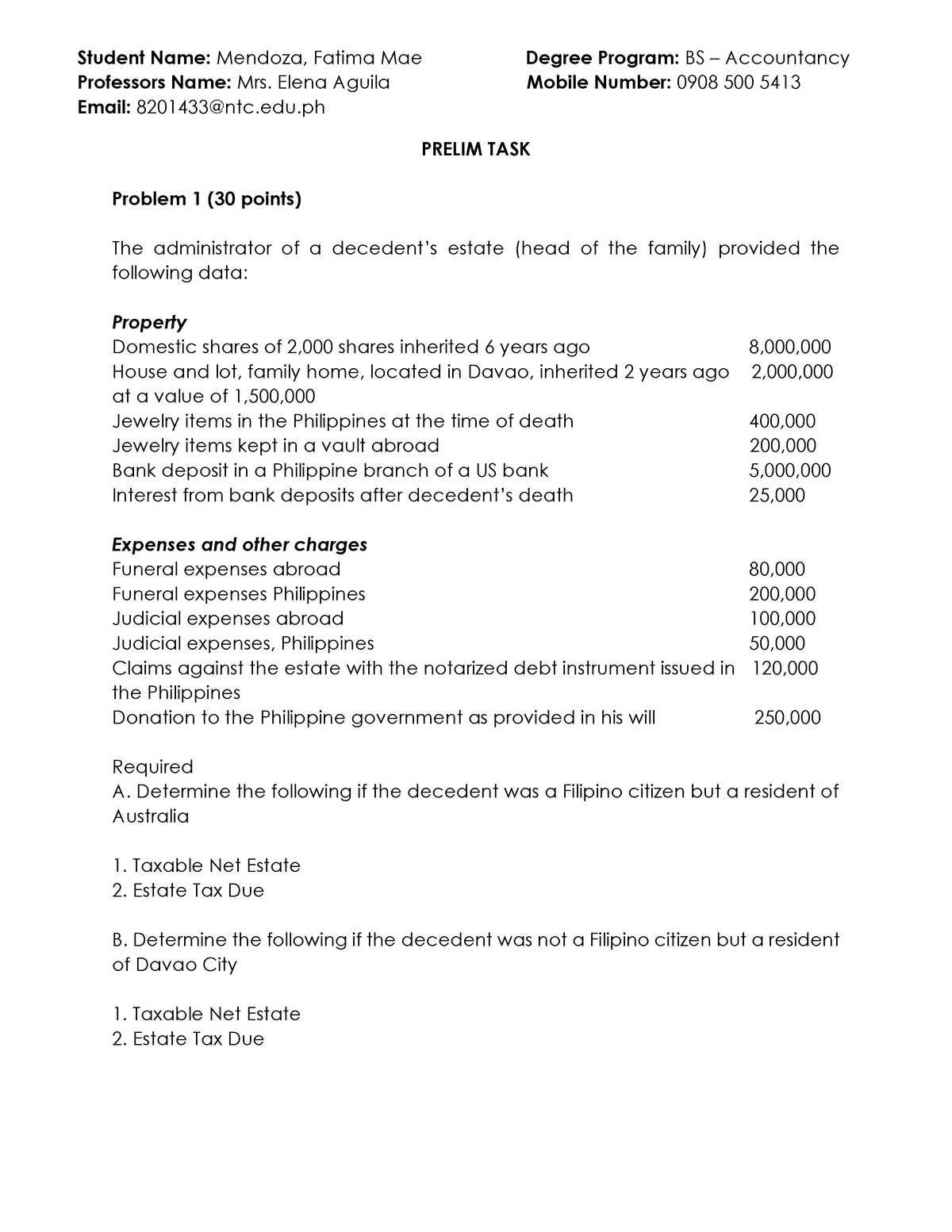

Mendoza Fatima Mae Prelim Prelim Task Problem 1 30 Points The Administrator Of A Decedent S Studocu

Can You Use Gofundme For Funeral Expenses Bare

Can You Use Gofundme For Funeral Expenses Bare

Are Funeral Costs Tax Deductible In Australia Ictsd Org

How Much Does A Funeral Cost Australian Seniors

Nj Estate And Inheritance Tax 2017

Solved Business Taxation Give The Correct Answer Course Hero

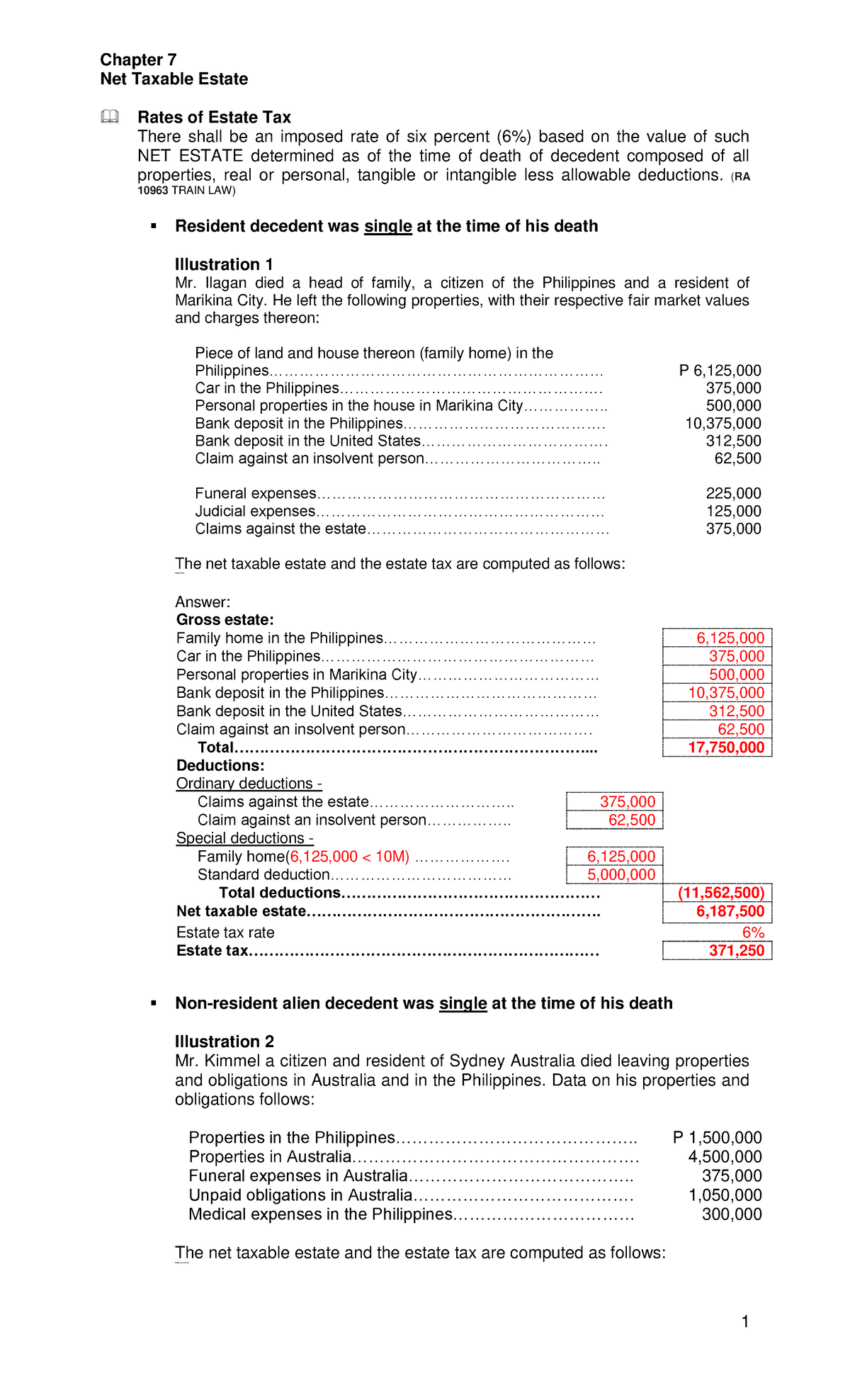

Chapter 7 Net Taxable Estate Net Taxable Estate Rates Of Estate Tax There Shall Be An Imposed Studocu

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Are Funeral Expenses Tax Deductible Uk Ictsd Org

Problem 1 The Administrator Of A Decedent S Estate Chegg Com

Ppt Calculating Tax Deductions Powerpoint Presentation Free Download Id 1716749

Ppt Calculating Tax Deductions Powerpoint Presentation Free Download Id 1716749